In the fast-paced world of currency trading, discerning traders must comprehend market sentiment and incorporate contrarian methods.

This research looks at the sentiment and technical positions of three major US dollar pairs: USD/JPY, NZD/USD, and USD/CAD, and provides a detailed market perspective to help traders navigate these complex markets.

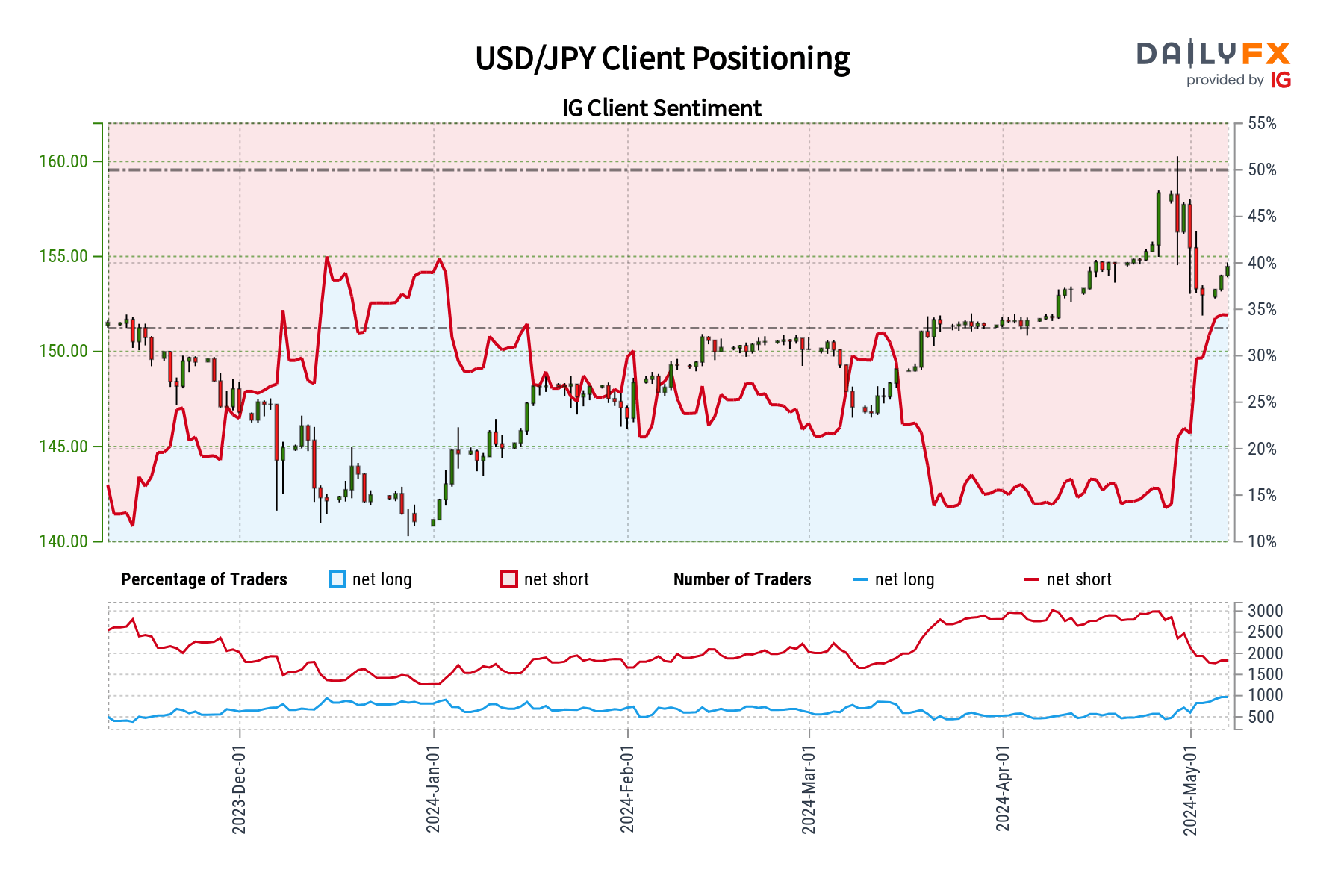

USD/JPY Sentiment and Outlook

IG client sentiment data indicate a negative tilt for the USD/JPY, with 66.90% of traders holding net-short positions. A significant short-to-long ratio of 2.02 to 1 indicates a possible upside from a contrarian standpoint.

However, a 3.20% day-to-day increase in shorts against a 25.37% decline over the week creates confusing signals, resulting in a neutral short-term bias for the USD/JPY. Contrarian ideas must be matched with technical and fundamental analysis.

NZD/USD Sentiment and Outlook

For the NZD/USD, 56.13% of traders are net-long, exhibiting a bullish attitude. However, a 3.30% daily and 17.00% weekly decline in net long positions suggests that bullish momentum is fading, pointing to a likely near-term fall.

Use sentiment and market analysis to forecast trend reversals.

USD/CAD Sentiment and Outlook

Traders are slightly more optimistic about USD/CAD, with 50.64% holding net-long positions. An 11.00% increase in net longs per day and a 28.78% increase per week indicate an increasing bullish sentiment, which could indicate a short-term decline.

For strategic trading, combine contrarian indicators with other analyses.

U.S. Dollar Index (DX) Futures Analysis

On the technical front, the U.S. Dollar Index fell 0.380, or -0.39%, to 98.081. The index tested a vital support zone between 97.920 and 97.470, indicating a small recovery if these levels hold.

Following a successful hold, key retracement objectives include 98.315, 98.355, and 98.520, which might lead to more upward momentum.

Economic Influences and Fed’s Position

Economically, US Treasury yields fell to new lows, with the 10-year yield falling to 1.116%, signaling a surge in risk-averse behavior in the wake of the coronavirus outbreak.

The Federal Reserve remains prepared to take action to support the economy, with the fed funds market fully expecting a rate cut at the upcoming March policy meeting.

Such economic considerations are important in determining dollar strength and should be regularly studied by traders.

Conclusion

For traders, combining sentiment analysis with a strong understanding of technical and fundamental indicators creates a solid foundation for navigating the USD markets. While contrarian indicators can identify probable reversals, they should not be employed alone.

To make sound trading decisions, stay up to date on economic changes and technical indicators. The USD's trajectory is still intimately linked to economic indicators and market sentiment, needing a cautious and responsive trading strategy.