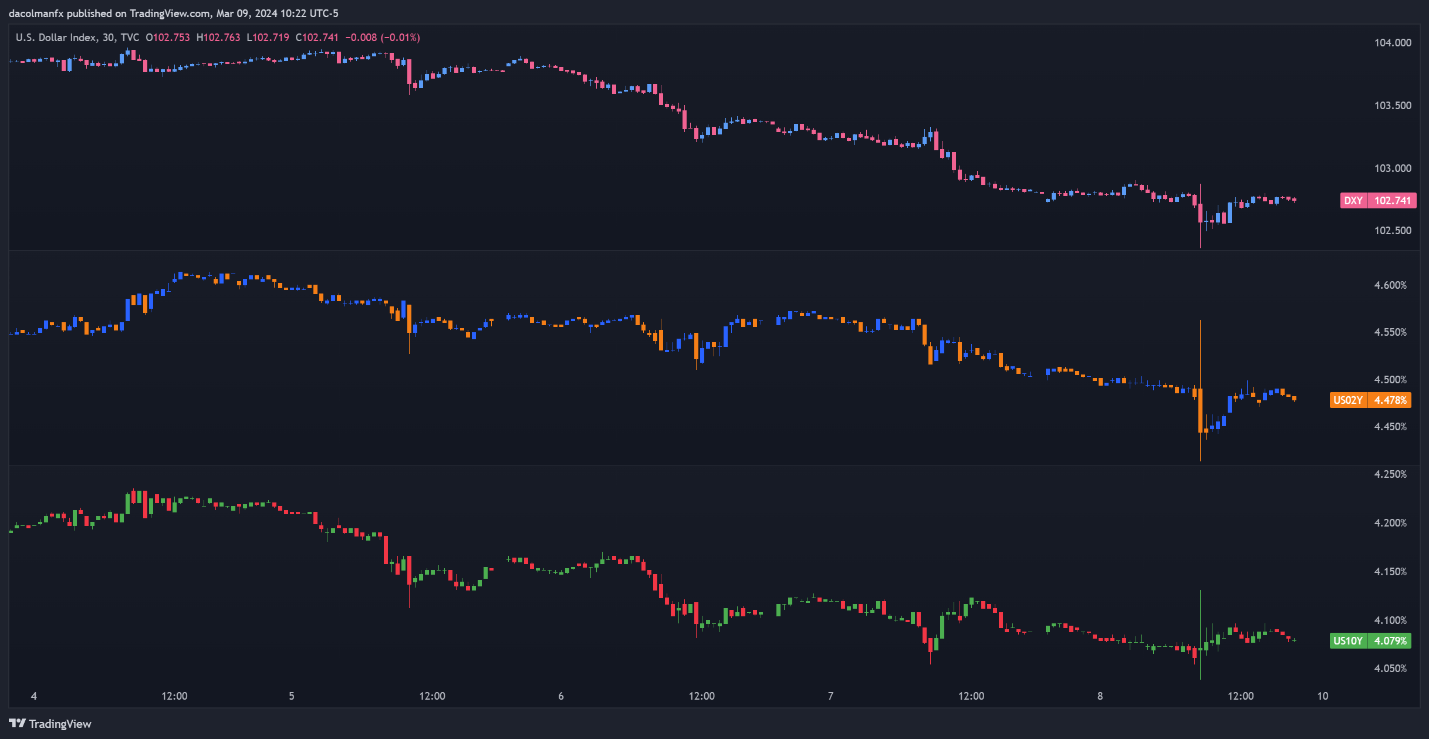

The US dollar fell sharply last week, spurred by decreasing U.S. Treasury yields are rising as the Federal Reserve is expected to lower borrowing prices. The DXY index dropped 1.10%, its worst weekly performance since early December. Despite Federal Reserve Chairman Powell’s cautious position on imminent interest rate decreases, his remarks have fanned speculation about a possible policy move in the near future.

US Dollar Index VS US Bond Yields

Powell’s speech to Congress, combined with mixed employment data showing a rise in the unemployment rate to 3.9% in February, has raised expectations of a rate drop as early as June, with market probabilities indicating a 57% possibility. This anticipation sets the scenario for a watershed moment for the US dollar ahead of the February CPI data announcement. If inflation statistics exceed forecasts, sentiment may shift quickly, perhaps reigniting dollar bulls.

Looking forward, while bears of the US dollar have regained the advantage, the tables may soon change. For example, if February’s US inflation data, which is due on Tuesday, outperforms consensus projections by a large margin, echoing January’s positive surprise, the atmosphere might shift at any time, allowing bulls to launch a comeback.

US Inflation Report

CPI data indicating modest progress toward disinflation should be good for the US currency, as they may provoke a hawkish repricing of the Fed’s roadmap. This is because, in such a scenario, investors would expect the Fed to hold interest rates higher for longer, resulting in a delay in monetary policy easing.

Inflation data heavily influences Fed policy expectations. Data indicating persistent inflation would likely boost the dollar, implying a slower pace of monetary easing. In contrast, lower-than-expected inflation might support a dovish stance, putting additional pressure on rates and the dollar. This makes the next CPI data an important event for market participants, with a focus on core inflation metrics.

EUR/USD Forecast – Technical Analysis

The EUR/USD has surged rapidly in recent days, breaking through numerous key resistance levels. If gains gather traction over the next week, a major ceiling to watch is at 1.0980, followed by 1.1020. Subsequent strength would then target on trendline resistance at 1.1075.

Conversely, if sellers make a surprising rebound and drive prices lower, the first technical floor to watch is at 1.0890. If the market falls further, the focus will go to confluence support at 1.0850 and then 1.0790.

USD/JPY Forecast – Technical Analysis

USD/JPY fell below 147.50 this week, settling at its lowest level since early February. If losses persist in the following trading days, initial support is seen at 146.50. Below this level, keep an eye on the 200-day simple moving average, which is slightly above 146.00.

On the other side, if US dollar bulls are able to launch a rebound, resistance is expected at 147.50. Beyond that point, all eyes will be on 148.90. Looking further, a further rise to the upside may see market attention shift to 149.70, then 150.90.

Final Thoughts

The approaching week marks a watershed moment for the US dollar, with inflation data expected to cause the next large move in major currency pairs. Traders should pay close attention to the CPI release, as it has the potential to change Fed expectations and, by extension, currency valuations. The dynamic nature of these developments emphasizes the need of remaining aware and prepared for sudden adjustments in market mood.