Dow Struggles Post-Fed Update

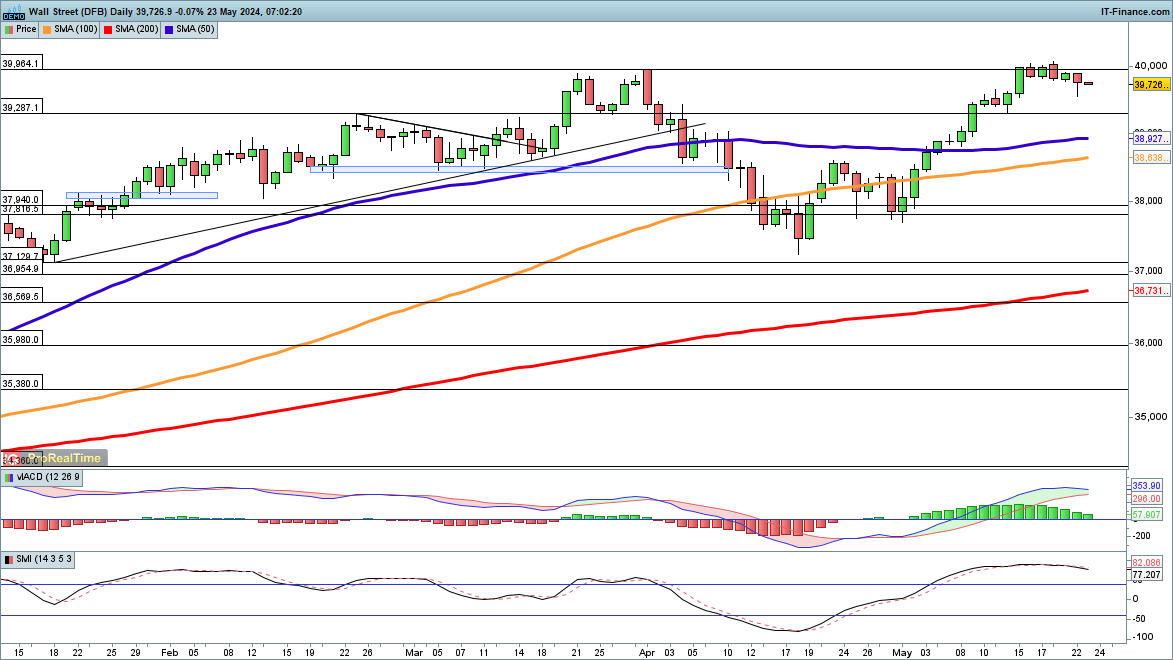

The Dow Jones Industrial Average experienced a dip as it consolidated following gains seen in late April and early May. The minutes from the Federal Reserve revealed concerns among some policymakers about persistent inflation. The possibility of additional rate hikes was suggested to manage inflation effectively.

Short-term support may form around the previous highs at 39,287, with the next key level being the 50-day simple moving average (SMA). A rebound above 40,000 would signal fresh upward momentum.

Nasdaq 100 Reaches New Heights

Boosted by strong earnings from Nvidia, the Nasdaq 100 surged to a new high, outperforming the Dow by maintaining its upward trajectory. The index continues to hover above its previous record of 18,352 set in March.

A potential pullback could occur if it falls below this record level.

Nikkei 225 Makes a Comeback

The Nikkei 225 initially dipped below its 50-day SMA but rebounded robustly, propelled by positive responses to Nvidia's earnings report. This recovery maintains the uptrend that began in mid-April, supported by the trendline from the April low.

Should it surpass the 39,000 mark, it would affirm the bullish outlook and challenge the trendline resistance from the March highs. Conversely, a drop below the trendline support might indicate the end of the recent upward trend.