Mixed Economic Indicators and Oil Demand

Crude oil prices rose somewhat on Thursday, fueled by a combination of weak economic statistics and continued geopolitical uncertainties.

The latest US Purchasing Managers Index (PMI) for April showed corporate activity at a four-month low, prompting oil prices to fall below $83 per barrel.

Despite a generally disappointing trading day in Europe, prices have held close to their opening levels. According to a recent report from the US Energy Information Administration, oil stockpiles have dropped significantly, indicating stronger exports rather than rising domestic demand.

Gasoline supplies fell, albeit less than expected, casting doubt on US energy demand.

Geopolitical Risks and Market Response

The market remains on edge due to persistent conflicts in Ukraine and the Middle East, which pose a constant threat to oil supply from key regions.

Tensions escalated with news of Israeli airstrikes on Rafah, Gaza, as Israel prepares for a potential ground invasion, heightening concerns over regional stability and its impact on oil supply lines.

Oil Market Technical Analysis and Trader Sentiment

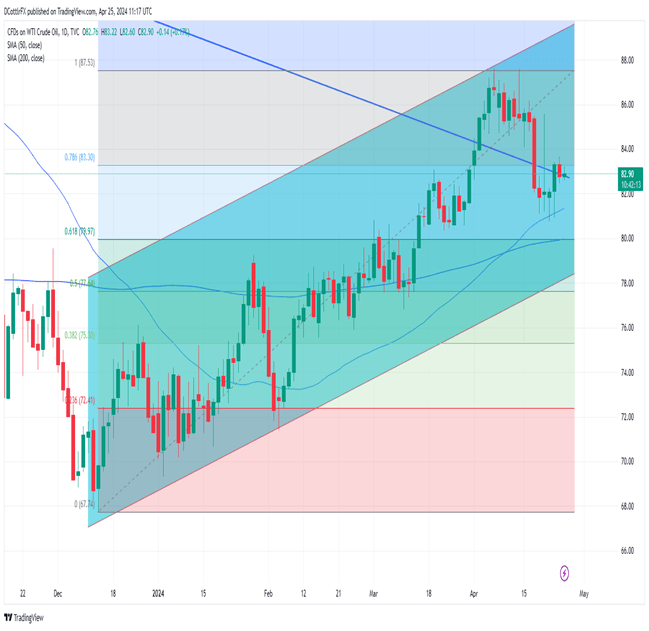

Technical analysis reveals that the West Texas Intermediate (WTI) benchmark is testing support levels at a downtrend line from mid-2022, which is currently around $82.77.

The market has remained resilient near the 50-day simple moving average, which is now marginally lower at $81.16, with strong support at $79.97.

The resistance level is $85.33, with near-term psychological barrier at $84.00. IG’s indicator measures trader sentiment, which remains strong, implying that the market’s larger rally may continue.

Final Thoughts

Despite the current economic and geopolitical headwinds, the oil market appears to be resilient. Traders should be cautious, especially with future economic data releases and happenings in the Middle East.

The balance of supply concerns and economic slowdown will most certainly continue to cause market volatility, making it critical for traders to regularly monitor these changing dynamics.