This article explores the benefits of investing in the FTSE 100 index and other major UK stock markets. This article covers three major methods of investment: Exchange-traded funds (ETFs), regular savings, and lump-sum investments. While these methods of the investment may seem to be the most appealing. Investing in UK stock market stocks is not for the faint-hearted. For a better understanding of the risks involved, read on!

Investing in the UK stock market is a great way to gain exposure to a variety of different sectors. The country's 6th largest economy has grown over the past four years and is a desirable place to live. Its economy is resilient to the Covid restrictions and is now showing positive results, despite the recent downturn. While some sectors are still vulnerable to a slump, the services sector is doing very well.

The UK market remains cheap compared to most developed markets and has a low valuation of technology companies. UK share prices are cheap when compared to the long-term average since 1990. Moreover, the dividend yields of UK companies are among the highest in the world. Investing in UK equities could be an excellent option for investors who are concerned about rising technology valuations. A key advantage of investing in the UK stock market is its relatively cheap valuation.

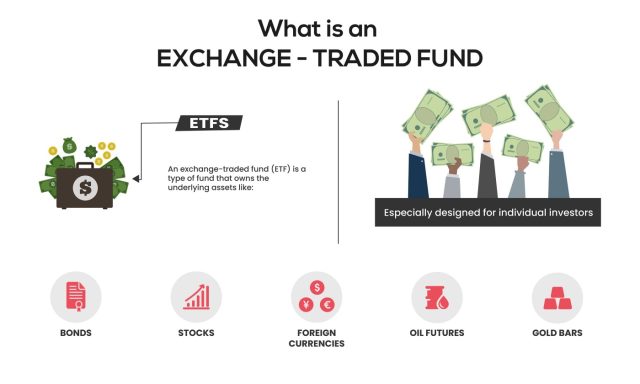

Investing through exchange-traded funds

ETFs are highly liquid investment vehicles that are geared towards diversification. They typically hold shares of a number of different companies that vary in price and risk. Investing in the UK stock market through exchange-traded funds (ETFs) can help you gain exposure to the U.K. stock market. Some ETFs are more volatile than others, and investors should consider the risk associated with each fund before investing.

First, investors must open an account with an investment platform or broker to purchase ETFs. Once they have a broker, they must do some research to determine what type of ETF to invest in. Among the factors to consider include the size of the fund and how much it costs to invest. In addition, investors must account for brokerage commissions, which can reduce their returns. Investing in the UK stock market through exchange-traded funds can be an excellent way to diversify your portfolio and increase your overall returns.

Investing a lump sum

While the UK stock market has historically performed well for investors who invest in large amounts, investors who make smaller, more frequent investments will benefit from dollar-cost averaging. This type of investing can provide an average return of 2.3% over a 10-year period. Investing with a lump sum has a higher risk profile, but can potentially increase returns. Listed below are some common myths about investing with a lump sum.

First, investing with a lump sum can be a great strategy for certain types of investors. Using the whole amount of money in one investment can lead to anxiety and short-term losses, but the numbers suggest that this strategy can make you a good investor over the long term. However, you should consider how much time you have to invest before making a decision. The longer your time horizon is, the greater your chances of achieving long-term success.

Investing through regular savings

A fresh start for UK stocks market by investing a lump sum, but if you do not have a lot of money saved up, a regular savings plan can help you build your portfolio while keeping the risks low. Saving for a house deposit may not be a good idea if you are putting all your money at risk. If you are saving for an emergency fund, you should ensure you have at least three or six months' living expenses saved. You shouldn't invest in the stock market for short-term expenses, but you should consider investing for long-term needs.

Regular savings plans are a great way to smooth out the fluctuations in the stock market. You can invest a small sum each month and let the money build up over the long term. Regular savings plans allow you to benefit from pound cost averaging, which means that you can purchase more fund units at a lower price. Plus, you can boost your returns when markets start to rebound. Make sure to research charges and fees carefully when choosing a savings plan.

Despite the positive economic news, UK equity valuations have been underperforming the global equity market over the past few years. A Brexit deal and a positive rollout of vaccines could give investors a big opportunity. Despite this, the UK share market is still not pricing this positive news, as the FTSE all-share trades at a near-record discount to the MSCI World Index – its lowest relative valuation since the dot-com bubble.

The stock market in the UK is based on market indices, which show which companies are doing well. The FTSE 100 is an index that tracks the 100 largest companies on the LSE, while the FTSE 250 is the next tier. FTSE 250 is a more accurate reflection of the UK economy than the FTSE 100. There is also the LSE 100, which lists all shares on the main LSE market.

The FTSE, which measures the performance of the largest companies on the London Stock Exchange, fell 5% between 8 June and the close of trading on the 14th. While falling stock markets are generally not a good time to buy shares, you should consider the type of company you are buying. While some companies' futures are better than others, there is no way to know for certain without researching their financial results. The key to investing in UK stock markets is to understand the risks and to choose your investments wisely.