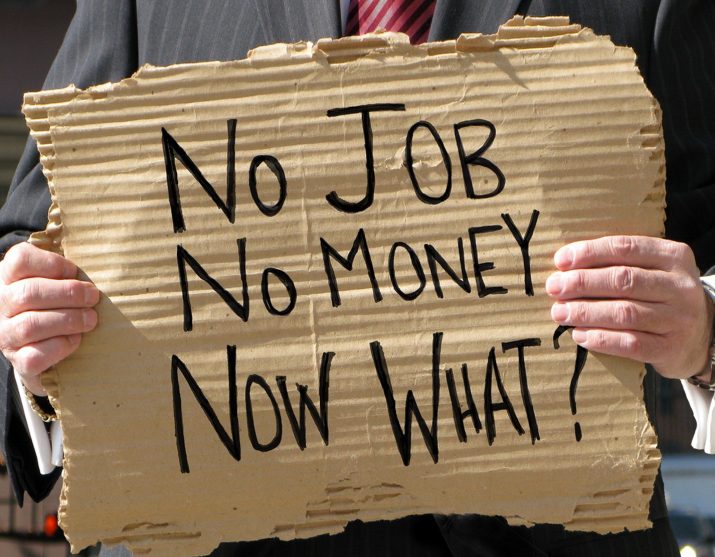

How Long Could You Survive Without A Job?

By Ali Luke

November 21, 2008 • Fact checked by Dumb Little Man

If you lost your job tomorrow, how long would you survive solely on your savings account? Here in the UK, a survey a few months ago revealed that a third of people have only enough saved to last them for eleven days.

However secure you think your job is, don’t assume that you’re immune to the current economic situation; good employees lose good jobs in bad times. Over the past several months, we’ve seen huge companies, once considered unbreakable, disappear overnight.

I am not going to tell you that I have a solution to our global economic dilemma. However, I am going to tell you that being fired while prepared is a lot better than being caught off guard. So, while you needn't get paranoid and start worrying that the sky is falling, you should work to prepare yourself a little. What is the contingency plan?

Here are four steps to get you started.

- Keep Your Resume Up To Date

This is something simple you could sort out today – making sure you have an accurate, fully up-to-date resume. If the last time you wrote a resume was when you applied for your current job, it might need a lot of updating. Check out dates and job titles, and think about the “soft skills” you want to include. Get someone to proof-read your resume for you. Make sure that it’s as well formatted and displayed as possible. And double-check your contact details; even if you haven’t moved, chances are you’ve changed your mobile number or email address in the past few years.

The last thing you want on your plate when bad news arrives is having to sort out your resume, so get into the habit of updating it on a regular basis – perhaps every six months.

See also:

Resume Presentation (from Monster.com)

- Build Up An Emergency Fund

If you have a meager savings account, start building up an emergency fund. This is something you only dip into in the case of dire need: being sacked, medical crisis, family disaster. Even if you can only save $20 a week, that’ll be $520 after six months (and that’s without interest): enough to make a significant difference if times get really tight.

Ideally, you want to get your emergency fund big enough to cover two or three months of expenses. Then, if you’re laid off, you have time to hunt for a new job without your family being in financial crisis.See also:

How and Why to Start an Emergency Fund (from Get Rich Slowly blog)

- Minimize Your Expenses Now

Cutting down on your outgoings now has two benefits:- You’ll start saving money which you can put into your emergency fund

- You won’t be paying unnecessary fees if you do lose your job

If you have gym membership that you rarely or never use, cancel it. Gyms and health clubs require a minimum of one month’s notice when you want to cancel – you don’t want to be hit with that steep monthly bill if you’re unemployed. Even if you are a regular gym-goer, look around for cheaper alternatives.

Hunt for a better deal on any forms of insurance you have. Look at household bills, and see what’s costing a lot. Can you cut down on phone calls during peak hours or use Skype as an alternative? Are you paying for an expensive monthly plan on your mobile when you only use half the minutes?

Don’t forget small, daily, expenses which can add up to more than the monthly ones. Brown-bag lunch to take into work, rather than buying a sandwich every day. Think about the costs of those bits and pieces you buy on impulse.

See also:

Evaluating Your Expenses: Housing (from The Simple Dollar blog)

Evaluating Your Expenses: Monthly Services (from The Simple Dollar blog)

- Build a Second Income Stream

Once you’ve sorted out your resume, started your emergency fund, and cut down on your expenses, you should be in a pretty good position to weather financial storms. However, this fourth tip allows you to actively get extra money – it could even grow to enough to replace your current job.

Starting a second income stream means finding a way to make some money, however little, outside your primary job. That could mean almost anything: running a stall at a Saturday market, making craft items with your kids and selling them on ebay (selling the craft items, that is, not the kids…), creating a website that attracts lots of readers and earns money through advertising, etc.

Good places to start building a second income stream are your hobbies and interests. What do you do in your spare time? How might you make money from it? Think creatively!

The internet has opened up a huge number of ways for everyday folks to make good money, and it’s worth looking for non-scammy opportunities. I’ve enjoyed the free material that Naomi from IttyBiz has published as part of her “Online Business School” which includes the audio part of one of the pay-for modules, about creating small websites.

See also:

7 Key Factors to Build Successful Income Streams (from Moolanomy blog)

40 Ways to Make Money on the Internet (from Dumb Little Man)

So what about you? How long could you survive if you lost your job tomorrow? What steps are you actively taking – or are you going to take – in order to make your financial situation secure, even with a temporary loss of income?

|

Written on 11/21/2008 by Ali Hale. Ali runs Alpha Student, a blog packed with academic, financial and practical tips to help students get the most out of their time at university. | Photo Credit: spaceodissey |