The January Personal Consumption Expenditures (PCE) Inflation Report was released by the Bureau of Economic Analysis, capturing attention for two main reasons: it’s the Federal Reserve’s (Fed) preferred way to gauge inflation, and it followed a higher-than-expected Consumer Price Index (CPI) report for January.

January PCE Inflation Report

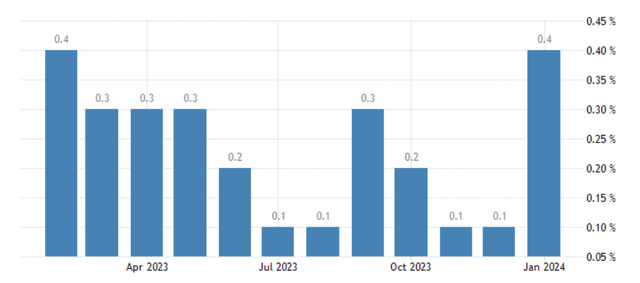

The Fed aims to keep inflation at 2% over the year, which means monthly increases in core PCE (which doesn’t include food and energy prices) should ideally be between 0.1% and 0.2%. However, January’s core PCE inflation rate was 0.4%, marking the highest since February 2023 and indicating an annual inflation rate of about 4.8%.

This 0.4% increase matches the core CPI for January, suggesting that inflation isn’t slowing down as hoped but might be picking up speed. Despite this, the year-over-year core PCE inflation has decreased to 2.849%, still above the 2% target. If this trend of higher monthly increases continues, we could see annual inflation rates start to climb again by summer.

The report also highlights that while goods prices have been decreasing, service prices have gone up by 0.6% in January—the biggest jump in the last 12 months. This mix of slowing goods price declines and rising service prices suggests inflation could be heating up.

Final Thoughts

The implications are significant for the Fed, which has been optimistic about inflation slowing down, based on previous months’ data showing inflation inching closer to the 2% target. However, recent data indicates that inflation remains stubbornly high, potentially requiring the Fed to slow the economy down to control price rises. This might mean fewer interest rate cuts than previously thought, despite market expectations.

The market initially reacted positively to the report, focusing on the year-over-year data showing inflation slowing. But this overlooks the real issue: inflation remains a concern, and the Fed may need to take stronger action to address it. Despite the optimistic market response, the underlying data suggest caution, especially for investors betting heavily on continued market rises.