Gold Price Stability Amid Volatility

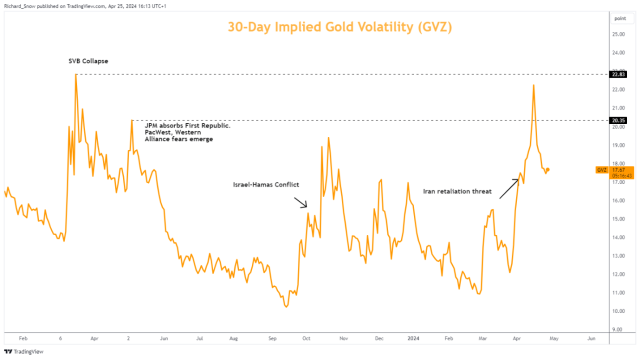

Despite decreasing market volatility as tensions in the Middle East have subsided, gold prices have remained resilient. Gold prices, which have traditionally been inversely related to the US dollar, have recently climbed in tandem with a strengthening dollar.

This implies a break from conventional market behavior, implying that traders may anticipate continuing support for gold prices even if the dollar continues strong.

Technical analysis identifies a support level at $2320, indicating possibility for upward movement if market conditions correspond with past patterns witnessed in March.

However, recent economic statistics from the United States, including a GDP shortfall and disappointing flash PMIs, hint to possible weaknesses that could affect future Federal Reserve policy.

This uncertainty in the United States’ economic stability may have a significant impact on future gold prices. Should the market turn negative, the next key support level is expected to be around $2222, followed by the 50-day simple moving average at $2200.

Silver’s Potential Bear Flag Formation

In contrast, silver prices have fallen, testing major Fibonacci levels and producing a bearish ‘Bear Flag’ pattern.

The price is currently hovering around $27.40, which serves as resistance. If the bearish pattern maintains, it could point to a drop to $26.31 or perhaps $25.53, based on prior drops’ Fibonacci extensions.

The potential support at $25.80 is critical to this study because it may act as a buffer against additional falls.

The recent market improvement in risk sentiment, fuelled in part by favorable developments in other financial sectors, has been insufficient to appreciably alter the direction of silver.

This suggests a complicated interplay between market sentiment and technical indicators, which traders should pay particular attention to.

Central Banks and Market Dynamics

The gold and silver markets continue to be influenced by broader economic data and central bank activity.

With central banks around the world expected to modify interest rates in reaction to ongoing economic movements, the precious metals market remains an important area for traders to monitor.

The possibility of rate cuts, along with continued geopolitical concerns, might further complicate the trading scene, presenting both obstacles and opportunities for the precious metals market.

Final Thoughts

For traders, the current state of the precious metals market presents a mix of caution and opportunity. Gold appears to be poised for potential increases, aided by macroeconomic uncertainty and central bank actions.

Silver, on the other hand, confronts a more hazardous situation, with technical indicators pointing to additional drops. To successfully traverse these complex markets, traders must be watchful, taking into account both technical setups and larger market sentiment.

Keeping a watch on incoming economic data and market trends will be critical for anyone hoping to profit from these fluctuations in gold and silver.