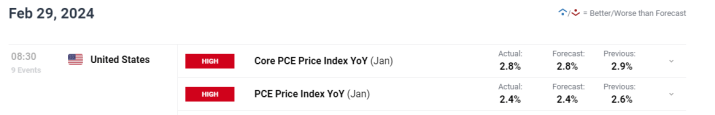

Due in part to a decline in U.S. Treasury yields in response to anticipated economic data, gold prices (XAU/USD) shot beyond $2,040 on Thursday, reaching their highest level since early February. With the core PCE deflator for January coming in at 0.4% m/m and 2.8% y/y, investors’ concerns about inflation were allayed following the release of the CPI and PPI data.

Despite the surge, caution is advised since market attitude may change if it becomes apparent that gradual disinflation and more accommodating lending terms could postpone Fed easing, which could put downward pressure on gold prices.

Key resistance levels for the metal are $2055 and $2070. The metal is now holding at $2038/oz, but it faces challenges from a strong dollar and high Treasury yields. Awaiting important U.S. inflation data that the Fed is interested in, gold futures remained stable midweek.

However, due to a strong dollar and rising Treasury yields, the precious metal is losing ground and is expected to see a monthly loss. Silver prices fell 2% month over month and 6% year over year, mirroring the reduction in gold prices.

The market’s cautious approach was reinforced by economic indicators such as the US 30-year mortgage rate, which remained steady at above 7%, and reports on mixed retail and wholesale inventories.

The January Personal Consumption Expenditures (PCE) Price Index, however, continues to draw attention. Core PCE is predicted to rise by 0.4%, potentially impacting the Fed’s decision to raise interest rates. Analysts predict a monthly increase of 0.3%.

All U.S. Treasury yields decreased, including large decreases in yields on 10- and 2-year bonds. On the other hand, as gold becomes more expensive for international investors, the U.S. Dollar Index (DXY) gained momentum in the middle of the week and is expected to grow by 0.7% this month and 2.6% so far this year. This puts more adverse pressure on gold.

In summary, given the contradictory fundamentals and technical indicators, the prognosis for gold (XAU/USD) remains uncertain. To predict the next move in the metal’s price, traders are waiting for more information on inflation data and Fed policies.

TECHNICAL ANALYSIS – GOLD PRICE FORECAST

Analyzing the future course of gold shows conflicting signals from fundamental and technical analysis. Nevertheless, the positive breakthrough on Thursday, when XAU/USD crossed over the 50-day simple moving average at $2,035 and above trendline resistance, is encouraging. Should this trend continue, a possible rally toward $2,065 may take place, after which the $2,090 mark may come into focus.

A reversal below $2,035 on the other hand may rekindle adverse sentiment and possibly lower the outlook for gold. Sellers may then aim for the 100-day simple moving average, which is located at $2,010/$2,005. A decline towards the $1,990 support area might then result from additional downward momentum.