Current GBP/USD Trader Sentiment Analysis

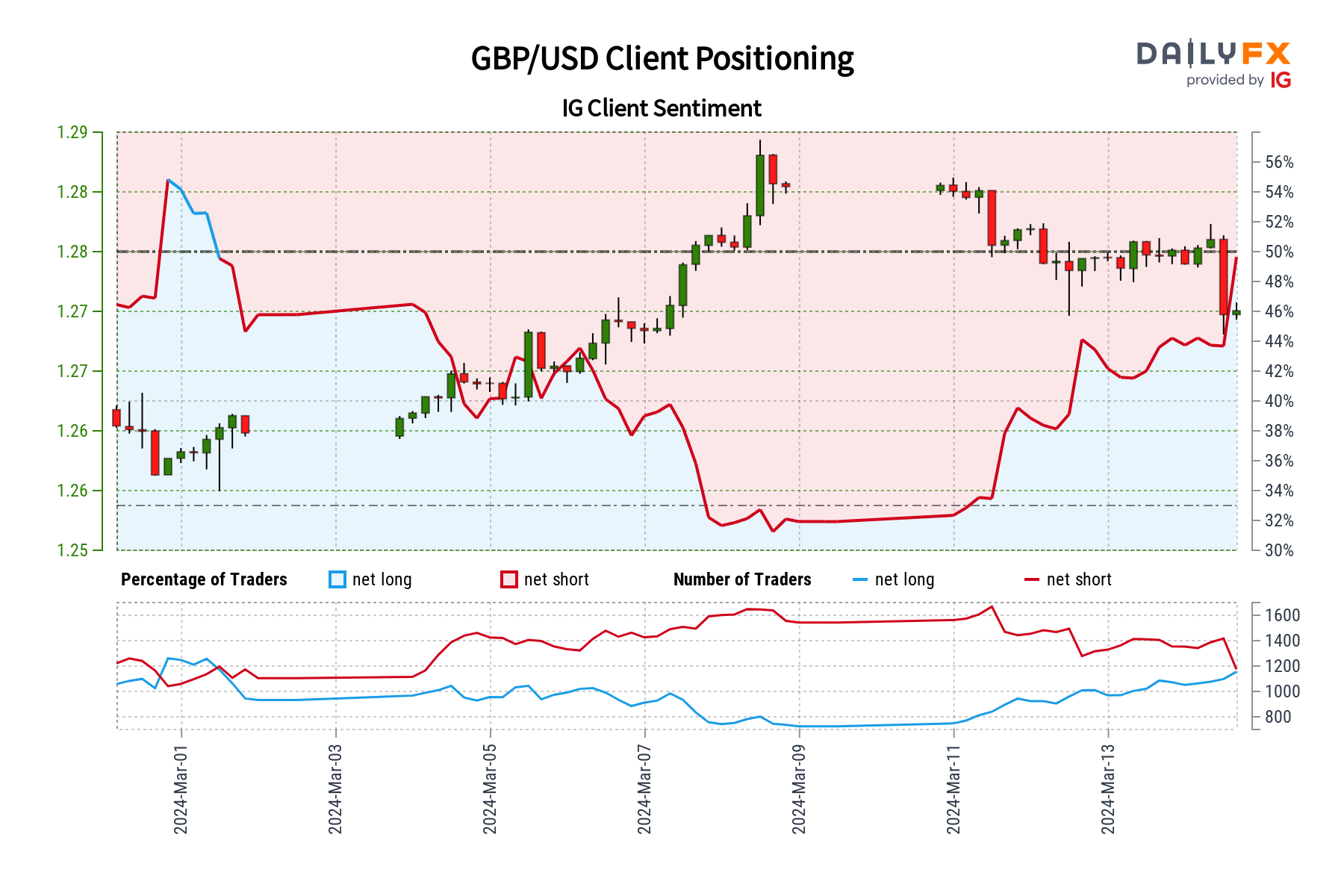

Recent retail trader data reveals that 50.21% of traders are now net-long on GBP/USD, showcasing a balanced ratio of long to short positions at 1.01 to 1. This shift towards a net-long positioning has been consistent since March 1, 2024, when GBP/USD hovered around 1.26, with the pair seeing a 0.81% uptick since. Notably, the proportion of traders net-long has surged by 11.27% compared to yesterday and 48.36% from the previous week. Conversely, the number of traders net-short has diminished by 16.13% since yesterday and 24.98% from last week.

Given the prevailing sentiment, our contrarian viewpoint suggests a potential downward trajectory for GBP/USD prices, as the current net-long bias could indicate future declines.

Sentiment Shift Signifies Potential GBP/USD Price Movements

For the first time since March 1, 2024, when the currency pair was priced near 1.26, our data points to a significant sentiment shift with traders now predominantly net-long on GBP/USD. This increased net-long stance, both from yesterday and last week, paired with the observed sentiment trends, amplifies our GBP/USD-bearish contrarian perspective. The analysis underscores a stronger indication that GBP/USD may face downward pressure, aligning with our contrarian trading bias.