As investors keenly await US inflation data, the DAX 40 steadies itself for potential uplift, while the S&P 500 continues its resilient ascent. Across the Pacific, the Nikkei 225 grapples with speculation surrounding the Bank of Japan’s policy direction, hinting at the intricate interplay of regional economic policies and global market reactions.

DAX 40 Awaits US Inflation Data with Steadiness

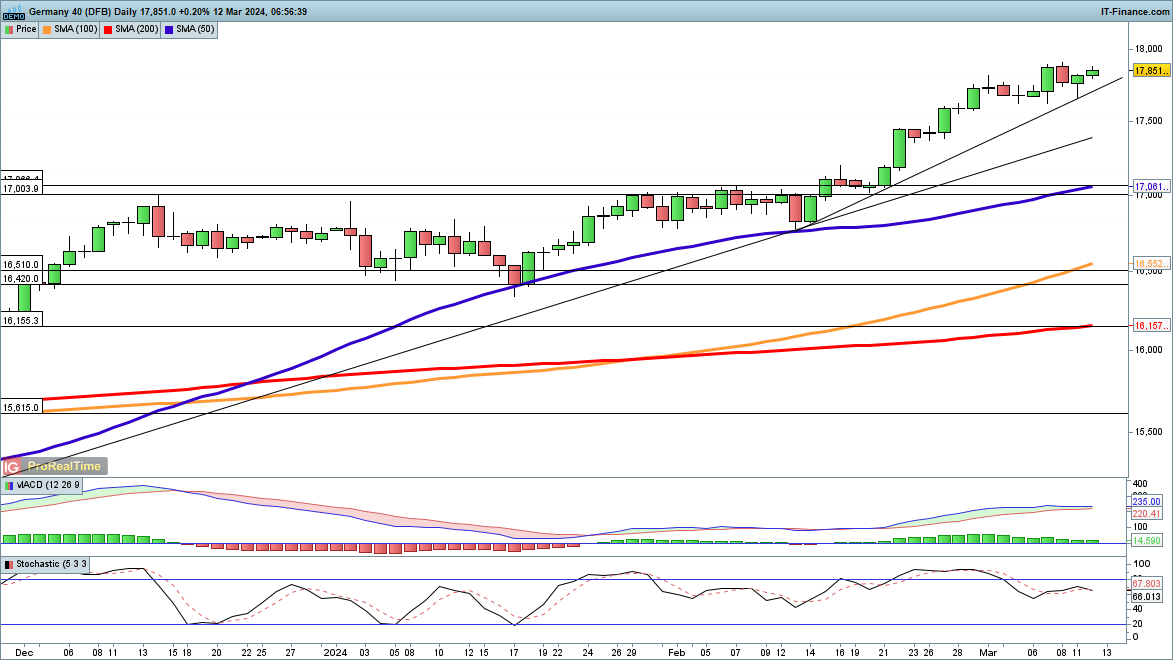

Following last week’s initial instability, the DAX 40 index rebounded early this Monday, sustaining an upward trend that has been in place since February. This momentum could drive the index towards a new record high, potentially reaching the 18,000 mark.

Support for the short-term trendline, beginning in February, bolsters the index. If this level breaks, the next supports are the late October trendline and then the 50-day simple moving average (SMA).

S&P 500 Continues its Upward Journey

Mirroring the trend of other US indices, the S&P 500 keeps climbing, unaffected by negative influences such as the absence of rate reductions or a decline in market breadth. The index found support around 5050 after recent declines, suggesting limited short-term downside risk.

The overarching trend remains upward, hinting at the possibility of new record highs in the near future.

Nikkei 225 Experiences Decline Amid Bank of Japan Speculations

The Nikkei 225 faced a sharp decline over the last four days, triggered by speculations about the Bank of Japan’s forthcoming monetary policy decisions. A further drop could lead the index towards the 50-day SMA or lower, potentially reaching the 37,000 level, which aligns with January’s peak.