Backwardation – Explained By An Expert 2024

By Jordan Blake

January 10, 2024 • Fact checked by Dumb Little Man

A market is in backwardation when there is a rise in demand for the underlying commodity in the spot market greater than the futures contract that expires shortly, signifying a bearish trend. A futures commodities market can either be in backwardation or forward action (contango), depending on the market conditions and the opinions of other market participants. However, backwardation in the commodities futures market is normal because it is a movement based on prevailing market conditions.

Backwardation is a market situation when future prices of a commodity are lower than the current price. It is often confused with “contango,” which means that the commodity's future prices are higher than the commodity's spot price. Backwardation does not occur regularly in the market; when it does, it's for a short time.

This article has Ezekiel Chew, a seasoned and world-renowned Forex mentor and expert, to share his take on backwardation within the commodities market. If you have you ever wondered how to profit from backwardation as an investor; This article has everything you need to know about backwardation and how to benefit from it. Scroll down to the paragraphs below for further information.

What is Backwardation

Backwardation is a market situation where a given asset's spot price or current market price is higher than the transacted trading future prices. Conversely, backwardation is also a market condition where the future contract prices are currently being transacted much lower than the spot prices of the given commodity or asset.

The spot price is the current market price for an asset or commodity, which will change throughout the day or over time due to supply and demand forces. In a situation where the futures contract price is lower than the spot price, it implies that the current market price is high and that the expected spot price will eventually fall and be much lower; this is backwardation.

In contrast, a backwardation is a form of contango that hardly occurs in the market because a backwardation influences the cyclic phases of supply and demand in the market as well as the spot prices and future prices.

Backwardation occurs when there is a higher demand for a commodity than the futures contracts that would subsequently mature in the market. Traders profit in backwardation by selling short at the current market price and buying at lower futures price.

Importance of Backwardation

In the market, when there is a shortage in supply of a given commodity in the spot market, there is a higher tendency that the market will gravitate towards backwardation. This will lead to increased spot prices that can restrict demand, but at the same time, it motivates the production of the given commodity and causes the manufacturers to quickly improve output because there is an opportunity to take advantage of the increased delivery prices.

When the spot prices rise for commodities, there is a tendency for more investors and short term traders to invest in the commodities markets; this, in turn, creates a market movement by the inflow of funds.

Backwardation is very beneficial for short term investors looking to profit from arbitrage opportunity because it acts as a leading indicator for the market to fall short since they expect the commodity to fall in value.

Basics of Futures

The basics of futures contracts are based on the commitment of a trader to purchase a particular asset, such as crude oil, while the seller is expected to sell the underlying asset at an already agreed future date, the reason it is called future. The futures price is the price of an asset or commodity futures contract that matures and concludes in the future.

For instance, if September's future contract maturity date is in September. The advantage of futures contracts is that traders can close a price by either buying or selling the basic asset. Every futures contract has predetermined futures price and maturity dates.

The traders buying futures contracts have control of a given asset or commodity at maturity or neutralize the contract with a trade. The net difference between the purchase and sale prices is cash-settled.

Backwardation vs Contango

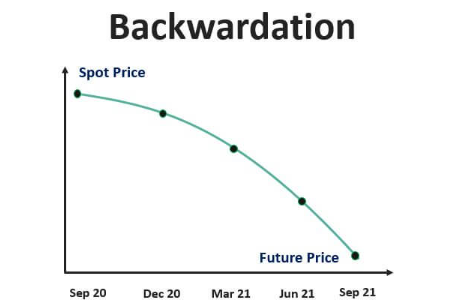

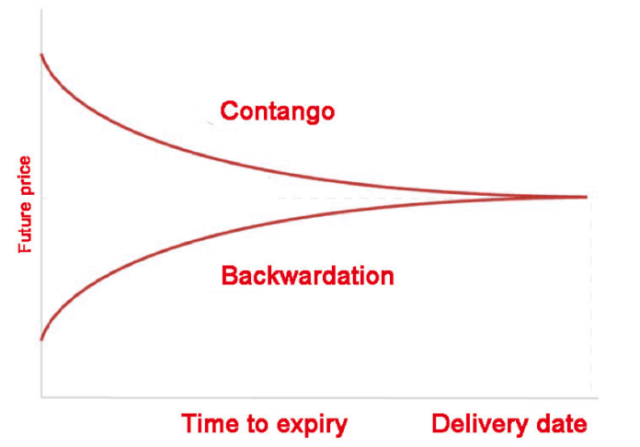

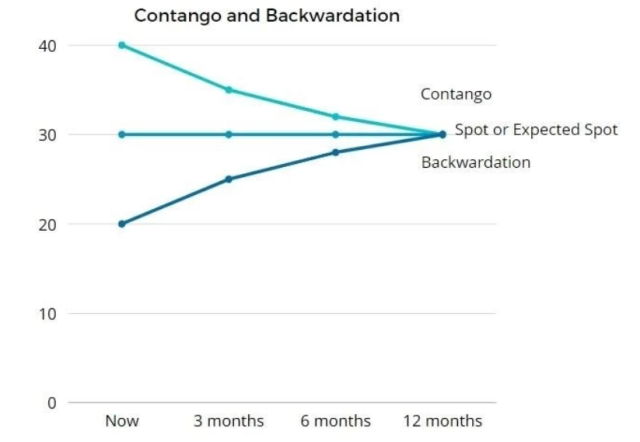

When futures prices are lower than spot prices with each successive maturity date in the market, the futures curve is described as a “downward-sloping backward curve.” This downward-sloping curve is known as backwardation, which is sometimes confused with an inverted futures curve.

In contango, the spot prices are higher with each successive maturity date in the futures markets; it is described as an upward sloping forward curve, also known as forwardation. For example, December's futures contract price is higher than November's and other months.

When futures price is higher than spot price, there's an expectation from market partice spot price will eventually rise to converge with the futures price. So, for example, traders will sell short futures contracts with higher spot prices in the future and buy the assets at lower spot prices.

The effect is that increased demand for the given asset forces the spot price to go higher, and over time, the spot price and the futures price converge. As a result, the futures market can shift between contango and backwardation and remain in both for a short or long period.

Example of Backwardation

Let's assume there was a crisis in Russia's crude oil production due to poor weather conditions. This crisis automatically affects the current oil supply such that there would be a drastic reduction. At this point, businesses and traders will flood into the crude oil market to buy the oil, which forces the current spot price up to $200 per barrel.

However, businesses don't expect the poor weather conditions to linger for long; as a result, the futures contract prices till the end of the year remain relatively unchanged at $100 per barrel. At this point, the oil producers would be in backwardation because the futures prices are much lower than the spot prices of oil.

In the coming months, the poor weather conditions will be resolved and stabilize, and crude oil supply and demand will return to normal as well as oil prices. Over time, the increased crude oil production forces the spot price to converge with the end-of-the-year futures contracts.

Best Forex Trading Course

Do you know you can make more than six figures in forex per trade and reduce the chance of losing your money? This is the secret most traders don't know about forex because they consider it too risky a business to venture in. If you're also like that, the Best Forex Trading Course by Ezekiel Chew is made for you.

He will lead you through every detail of forex trading until you fully understand how it works while holding your hand. With this course, making a six-figure profit and more per trade will become easy.

Ezekiel Chew's strategy is based on how to use correlation to predict GDP results, backed by mathematical probability.

The Asia Forex Mentor is the only foundational program that traders worldwide have tried and trusted. It is a comprehensive program that addresses levels from beginner to advanced. People who have taken part in the training, from beginners to full-time traders, have reported astonishing success in their subsequent trading endeavors.

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

4 Best Forex Brokers

| Broker | Best For | More Details |

|---|---|---|

| Advanced Non US Traders Read Review | securely through Avatrade website |

Multi Asset Trading Platform Read Review | securely through Roboforex website | |

Professional Traders | securely through FXchoice website | |

| Copy Traders Read Review | securely through FXTM website |

Conclusion: Backwardation

A market situation where the futures prices of commodities are lower than the spot prices or current prices of the commodities is called backwardation. On the other hand is contango, the opposite of backwardation, where the future prices of commodities are higher than the spot prices of the commodities.

In backwardation, the urgent need to purchase the commodity outweighs its cost, and over time, as the expiration dates of the futures contracts approaches, the spot prices and future prices converge to meet the spot prices at lower prices, negating any arbitrage opportunity.

Investors use backwardation as a technical analysis tool to estimate the current future prices in affiliation with the future spot prices of an asset or commodity during delivery. This converging point of the expected spot price and the current spot price helps investors on the current move about going long or short.

Backwardation FAQs

How do you profit from Backwardation?

Benefiting from backwardation is attained when investors acquire a prospects contract that trades under the anticipated spot price. The gain comes over time after the prospect's price corresponds with the spot price.

What does backwardation in oil mean?

Backwardation in oil means the current price is more prominent than prices for the forthcoming period and motivates traders to trade and lessen supplies.

Is backwardation bullish or bearish?

When traders speculate that the rates in the prolonged term will reduce, then backwardation in such market will be bearish and vice-versa for an expected bullish market.

Jordan Blake

Jordan Blake is a cultural commentator and trending news writer with a flair for connecting viral moments to the bigger social picture. With a background in journalism and media studies, Jordan writes timely, thought-provoking content on everything from internet challenges and influencer scandals to viral activism and Gen Z trends. His tone is witty, observant, and sharp—cutting through the noise to bring readers the “why” behind the “what.” Jordan’s stories often go deeper than headlines, drawing links to pop culture, identity, and digital behavior. He’s contributed to online media hubs and social commentary blogs and occasionally moderates online panels on media literacy. When he’s not chasing the next big trend, Jordan is probably making memes or deep-diving into Reddit threads. He believes today’s trends are tomorrow’s cultural history—and loves helping readers make sense of it all.