Stocks climbed today, with the S&P 500 increasing by 1.2%, continuing the upward trend from yesterday. The market’s movement has been typical of a negative gamma trend where rallies appear unexpectedly.

This is likely to change with upcoming economic data indicating potential rebounds in interest rates and the US dollar.

Today’s 5-year Treasury auction may not impact the market significantly but is important to monitor. The real focus will be on Thursday when GDP data is released, which could drive interest rates.

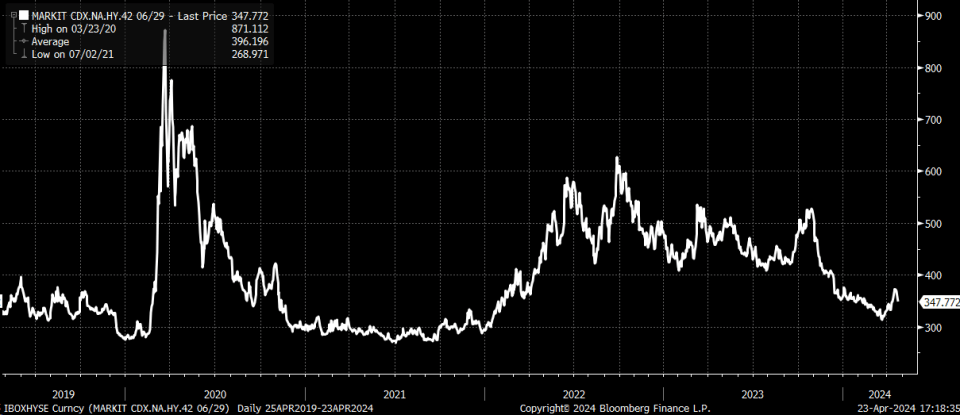

Credit spreads have narrowed, facilitating a recovery in equities. These spreads need to remain tight for the stock rally to persist.

However, if GDP data aligns with the Atlanta Fed’s GDPNow forecast of 2.9% or exceeds the median estimate of 2.5%, we may see rates and the dollar rise, causing spreads to widen.

Next week is filled with key data releases including employment cost index, jobs data, JOLTS, ADP, and ISM. The Federal Reserve meeting on Wednesday will likely be a significant event. An influx of data could lead to increased implied volatility, particularly in shorter-dated S&P 500 options.

The S&P 500 has recovered 38.2% of its recent decline.

Tesla’s stock jumped following its earnings release. Despite disappointing results initially, announcements of cheaper models pushed the stock above $150, crucial for market makers to start buying back hedges.

This action was likely all that was needed to elevate the stock, even with revenue and earnings missing forecasts. Gross margins were better than expected at 17.4%, with automotive gross margins even higher at 18.5%.

If Tesla remains above $150, a short squeeze to the $170s is possible.